Twogether Updates

CBT (Computer Based Training) For Entering Claims For HCS & TxHmL Services As Of March 1st, 2022

February 8th, 2022

CBT (Computer Based Training) For TMHP Billing of Services/Entering Claims

For those of you asking where to submit claims for HCS & TxHmL services after March 1st, this will be via TMHP. CARE will no longer be used to submit these claims as of March 1st, 2022. Training on how to submit your claims can be found on the TexMedConnect for LTC Providers portal via CBT training.

TexMedConnect for Long-Term Care (LTC) Providers

“This CBT contains information about using TexMedConnect to verify client eligibility, enter and submit claims and appeals, and find claim status.

The TexMedConnect for Long Term Care Providers CBT helps providers with:

– Logging on to TexMedConnect;

– Using the Medicaid eligibility and service authorization verification (MESAV) function;

– Entering, saving, and submitting claims and adjustments:

– Using the Claim Data Export, Claim Status Inquiry (CSI), Pending Batch, and Batch History functions; and

– Viewing Remittance and Status (R&S) Reports and Claims Identified for Potential Recoupment (CIPR) Provider Reports.”

See the link below for CBT Training for claims and other TMHP functions:

https://tmhp.exceedlms.com/student/path/181116-texmedconnect-for-long-term-care-ltc-providers

Can An HCS Program Provider Provide Services To Their Own Child Or Family Member?

I recently received this response from HHSC and thought it might be helpful to some providers who may have this concern:

There is no rule or regulation that prohibits an HCS Program Provider from providing services to their own child or family member. You can pop over to this site to get in touch with the best lawyers who will help you to claim this scheme.

The program provider’s operations must prevent conflict of interest as required by 40 TAC §9.177(f):

§9.177 Certification Principles: Staff Member and Service Provider Requirements

(f) The program provider’s operations must prevent:

(1) conflicts of interest between the program provider, a staff member, or a service provider and an individual, such as the acceptance of payment for goods or services from which the program provider, staff member, or service provider could financially benefit, except payment for room and board;

(2) financial impropriety toward an individual including:

(A) unauthorized disclosure of information related to an individual’s finances; and

(B) the purchase of goods that an individual cannot use with the individual’s funds;

(3) abuse, neglect, or exploitation of an individual;

(4) damage to or prevention of an individual’s access to the individual’s possessions; and

(5) threats of the actions described in paragraphs (2) – (4) of this subsection.

And, the program provider must ensure they are not disqualified from being a service provider as described in Section 3420(b)-(d) of the HCS Billing Requirements:

3420 Service Provider Not Qualified

Revision 21-3; Effective September 1, 2021

(b) Spouse Not Qualified as Service Provider

A service provider is not qualified to provide a service component or subcomponent to the service provider’s spouse.

(c) Relative, Guardian or Managing Conservator Not Qualified as Service Provider for Certain Services

A service provider is not qualified to provide case management, residential support, supervised living, behavioral support services or social work services to an individual if the service provider is:

(1) a relative of the individual (Appendix II, Degree of Consanguinity or Affinity, explains who is considered a relative for purposes of these requirements);

(2) the individual’s guardian; or

(3) the individual’s managing conservator.

(d) Parent, Spouse of Parent or Contractor Not Qualified as Service Provider for Minor

A service provider is not qualified to provide a service component or subcomponent to a minor if the service provider is:

(1) the minor’s parent;

(2) the spouse of the minor’s parent; or

(3) a person contracting with DFPS to provide residential child care to the minor, or is an employee or contractor of such a person.

According to Section 3430 of the HCS Billing Requirements:

3430 Relative, Guardian or Managing Conservator Qualified as Service Provider

Revision 21-1; Effective January 1, 2021

If a relative, guardian or managing conservator is not otherwise disqualified to be a service provider as described in Section 3420, Service Provider Not Qualified, or in Section 4000, Specific Requirements for Service Components Based on Billable Activity, the relative, guardian or managing conservator may provide audiology services, dietary services, occupational therapy, physical therapy, speech and language pathology services, day habilitation, in-home day habilitation, registered nursing, licensed vocational nursing, specialized registered nursing, specialized licensed vocational nursing, transportation as a supported home living activity, host home/companion care, respite, in-home respite, employment assistance or supported employment if the relative, guardian or managing conservator is a qualified service provider for the particular service component or subcomponent being provided.

HCS/TxHmL Writing Acceptable Plans of Correction Webinar-Feb. 9th, 2022

February 1st, 2022

HCS/TxHmL Writing Acceptable Plans of Correction Webinar

“WHAT IS A POC? 42 CFR §488.401 defines a Plan of Correction to mean a plan developed by the facility and approved by CMS or the survey agency that describes the actions the facility will take to correct deficiencies and specifies the date by which those deficiencies will be corrected.Apr 19, 2021″

Program providers can register for the Writing Acceptable Plans of Correction for HCS and TxHmL webinar. This webinar covers the process for writing an acceptable plan of correction for HCS and TxHmL program providers. No CE is awarded for this webinar. However, a certificate of attendance will be provided.

This will be an ongoing offering posted on the HHCS HCS/TxHmL Joint Training website.

Wednesday, Feb. 9

1 – 4 p.m.

Register for the webinar.

Email questions to Joint Training.

Allowance of Delivery of PT, OT, and ST Services Via Telehealth (IL 2022-08)

February 1st, 2022

HHSC Publishes Information on Delivery of PT, OT, and ST Services (IL 2022-08)

HHSC is issuing interim guidance allowing telehealth delivery of physical therapy, occupational therapy, and speech therapy services. Access Information Letter No. 2022-08, HB4: Physical Therapy, Occupational Therapy, Speech Therapy Services Delivered by Synchronous Audio-Visual. The letter notes which therapies are not allowed to be delivered through telehealth modalities because the service requires in-person delivery.

This guidance applies to the following programs:

- Community Living Assistance and Support Services Providers

- Deaf-Blind with Multiple Disabilities Providers

- Home and Community-based Services Program Providers

- Texas Home Living Program Providers

Email the LTSS policy mailbox with questions about this alert.

COVID-19 Cases Continue to Rise – What Should LTC Providers Do?

February 1st, 2022

Guidance for LTC Providers

COVID-19 cases continue to increase across Texas. HHSC reminds providers to follow the guidelines listed below and ensure their emergency plan is up to date. Staff must be aware of what to do in the event of any sort of emergency, including an outbreak of flu or COVID-19.

Please review the following rules, guidelines, and policies:

- COVID-19 mitigation and visitation rules for your provider type

- Any applicable COVID-19 response plans for your provider type

- Your organization’s infection prevention and control policies

All provider types must continue to screen residents, clients, staff, and visitors for signs and symptoms of COVID-19.

Staff for all provider types must continue to use appropriate personal protective equipment (PPE).

Where required by rules for your provider type, providers must continue effective cohorting of residents based on COVID-19 status.

Find COVID-19 resources for your provider type online:

- The COVID-19 Resources section of your provider portal

- The HHSC Coronavirus (COVID-19) Provider Information page

Your maintaining vigilance in following infection control requirements makes a difference in protecting vulnerable Texans.

LTC providers are always required to provide services to residents before, during, and after any emergency. Your organization’s emergency plan or policy must include:

- Planning for staff shortages

- Back-up plans to ensure operations and care of residents or clients continues

Read program-specific rules related to staffing, emergency preparedness, and infection control:

- Intermediate Care Facilities for Individuals with an Intellectual Disability or Related Conditions

- Home and Community-based Services

- Texas Home Living

The U.S. Department of Health and Human Services has developed a COVID-19 Healthcare Planning Checklist (PDF) that you can use to assist you in creating a plan for dealing with an outbreak of flu or COVID-19.

For questions, email LTCR Policy.

HHSC has published ICF and HCS Emergency Staffing Requests Letter – Jan. 10th, 2022

HHSC has published ICF and HCS Emergency Staffing Requests – Jan. 10

HHSC has published ICF and HCS Emergency Staffing Requests (Provider Letter 2022-02). This letter provides information for Intermediate Care Facilities for Individuals with an Intellectual Disability (ICFs) or Related Conditions and Home and Community-based Services (HCS) program providers facing staffing shortages related to the COVID-19 public health emergency.

ICF & HCS Surveys: Backlog of Surveys and Compliance Expectations

January 14th, 2022

HCS program providers also need to be able to show compliance at all times.

For recertification surveys, surveyors will look at records from after the last recertification survey exit date forward to the present survey. 40 TAC 9.178(g) provides that “the program provider must make available all records, reports, and other information related to the delivery of HCS Program services and CFC services as requested by HHSC, other authorized agencies, or CMS and deliver such items, as requested, to a specified location.”

In regards to the backlog, as per our survey ops partners, ICF/IID should be up-to-date on their annual surveys and LTCR is working on completing [HCS/TxHmL] surveys and working through any outstanding backlogs.

Vaccine Mandate Updates

Texas COVID-19 Coronavirus Resources & Guidance for People with Disabilities

Check Out These Resources For Persons With Disabilities From The Office of Texas Governor Greg Abbott

https://gov.texas.gov/organization/disabilities/coronavirus

https://tcdd.texas.gov/resources/covid-19-information/government/

Texas COVID-19 Coronavirus Resources & Guidance for People with Disabilities

State Agencies and Councils COVID-19 Pages

- Department of Family and Protective Services

- Department of State Health Services

- Texas Health and Human Services Commission

- Texas Council on Developmental Disabilities

- Texas Department of Emergency Management

- Texas Education Agency

- Texas Workforce Commission

- Commission on State Emergency Communications

Effective Communication Tips for Community Vaccination Sites

Accessible Guidance

- Easy to read COVID-19 Safety Guidelines

- CDC COVID-19 guidelines in ASL on YouTube

- Center for Inclusive Design and Innovation (CIDI) Accessible Resources

- Braille resources;

- Other alternative formats (e.g., for people who access the Internet using screen readers)

COVID-19 Vaccine Information in ASL

- DSHS Commissioner COVID-19 Vaccine Update in ASL

- FEMA released the following videos on accessing video remote interpreting (VRI) and the language line when you getting your vaccine at a community vaccination center:

- FEMA Accessible: Community Vaccination Centers Language Access (ASL) (Open Caption)

- FEMA accesible: Acceso en su idioma a los centros comunitarios de vacunación

- ASL VRI Support Flier

The ADA and Face Mask Policies

The Great Plains ADA Center has created a frequently asked questions page to help clarify some of the questions surrounding the ADA, mask orders, and disability.

Mental Health Support

The Substance Abuse and Mental Health Services Administration (SAMHSA) operates a free, 24/7, 365-day-a-year disaster distress helpline. This line provides crisis support and counseling to people experiencing emotional distress related to natural or human-caused disasters. Call or text 1-800-985-5990 to connect with a trained crisis counselor. Deaf and hard-of-hearing callers can contact the same number through their videophone to access 24/7 ASL support.

Rules for Everyone

The Texas Department of State Health Services (DSHS) recommends these simple, everyday actions to help prevent the spread of COVID-19:

- Wash your hands often and for at least 20 seconds (long enough to sing “Happy Birthday” twice). Be sure to encourage friends and family to do the same;

- If no soap and water are available, use hand sanitizer with at least 60% alcohol. Remember that soap and water are the gold standard;

- Cover coughs and sneezes with a tissue (if you don’t have a tissue, sneeze into the crook of your elbow), then throw the tissue away. Wash your hands after!

- Avoid touching your eyes, nose, and mouth with unwashed hands;

- Disinfect frequently touched surfaces like buttons, handles, knobs, and counters. Your cell phone is your “third hand,” be sure to sanitize it often.

- Avoid close contact with people who are sick;

- Practice social distancing- this includes avoiding crowds and maintaining six feet of distance between you and others in public.

- DSHS has created a social media toolkit as well as other resources that you can use to spread the word on how to help slow the spread of COVID-19.

Follow Texas DSHS COVID-19 Updates

Emergency Rental Assistance

The Texas Department of Housing and Community Affairs (TDHCA) has received $1.3 billion in Emergency Rental Assistance funds from the Coronavirus Relief Bill. TDHCA’s Texas Rent Relief program website and phone systems are active. TDHCA accepts applications from landlords and tenants.

- To learn more about the program and apply online go to TexasRentRelief.com

- To learn more about the program and apply by phone, call 833-9TX-RENT / 833-989-7368.

For more information on the Texas Rent Relief program go to the TDHCA FAQ page.

Additionally, the Texas Eviction Diversion Program (TEDP) was created by the Supreme Court of Texas, Texas Office of Court Administration and TDHCA to help eligible tenants stay in their homes and provide landlords with an alternative to eviction. A portion of the Texas Rent Relief funds is reserved for this activity.

Guidance on “Long COVID” as a Disability Under the ADA, Section 504, and Section 1557

Although many people with COVID-19 get better within weeks, some people continue to experience symptoms that can last months after first being infected, or may have new or recurring symptoms at a later time. This can happen to anyone who has had COVID19, even if the initial illness was mild. People with this condition are sometimes called “long-haulers.” This condition is known as “long COVID.” In light of the rise of long COVID as a persistent and significant health issue, the Office for Civil Rights of the Department of Health and Human Services and the Civil Rights Division of the Department of Justice have joined together to provide the following guidance:

GCPD COVID-19 Webinars

COVID-19 Vaccine and People with Disabilities Q&A, presented on March 9, 2021

- DSHS’s Answers to Follow-Up Questions in PDF Format

- DSHS’s Answers to Follow-Up Questions in Word Format

HHSC and TEA COVID-19 Disability Policy Q&A, presented on April 17, 2020

COVID-19: Considerations for Individuals with Disabilities, presented on April 1, 2020

- HHSC’s Answers to Webinar Questions in Word Format

- HHSC’s Answers to Webinar Questions in PDF Format

Communication

Tips for Successful Communication with People with Disabilities

Communication Tips in Word Format

Communication Tips in PDF Format

Communication Tips in Spanish

It is imperative emergency management information be made accessible in order to integrate the needs of people with disabilities. The Americans with Disabilities Act (ADA) and the 21st Century Communications and Video Accessibility Act (CVAA) require emergency management information to be made accessible in order to integrate the needs of people with disabilities. Accessible information helps support the needs of the whole community and makes sure no one is left without potentially lifesaving information. GCPD reminds broadcasters of the steps that need to be taken in order to make sure information is accessible, as well as the availability of the State of Texas Effective Communications toolkit.

The Federal Communications Commission (FCC) has released additional guidance on accessible televised emergency communication. Community situations such as pandemics are considered emergencies. Information about a current emergency that is intended to further the protection of life, health, safety, and property must be provided visually and aurally.

Education

The Texas Education Agency (TEA) COVID-19 page provides updates on school closures as well as the continued responsibility to provide education to students with disabilities.

As colleges and universities have transitioned to digital learning platforms as part of a campus mitigation plan, GCPD reminds them of their legal responsibility to ensure access to curriculum and instruction for students with disabilities. This includes practical considerations, such as making sure instructional materials are captioned and making use of Video Remote Interpreting and Video Relay Services to provide interpreters in class.

The CDC and Department of Education have provided additional guidance on providing services to students with disabilities during COVID-19. By helping childcare programs, schools, and their partners understand how to prevent the transmission of COVID-19 within their communities and facilities, administrators can help flatten the curve. In addition to mitigation planning, this guidance includes considerations to help administrators plan for the continuity of teaching and learning. Finally, this guidance includes a decision tree to help schools and facilities determine which mitigation plan is best in three scenarios: all schools regardless of community spread, no community spread, and minimal to moderate or substantial community spread.

Health

Governor Abbott has waived certain regulations in order to increase access to telemedicine and prevent unnecessary exposure via in-person doctor visits.

The Texas Health and Human Services Commission (HHSC) has issued guidance relating to certain Medicaid waivers, such as Home and Community-Based Service (HCS) and Texas Home Living (TxHmL). Similar to the guidance prohibiting non-essential visitors in nursing homes and other institutions, HHSC has mandated HCS and TxHmL providers prohibit visitation from non-essential personnel. Given that many group homes serve medically fragile individuals, it is necessary to take strong precautions to prevent the spread of COVID-19 among this population.

HHSC’s, DSHS & CDC Update: COVID-19 Omicron Variant

January 10th, 2022

When was Omicron Variant First Found in Texas and What is This Variant of COVID-19? (Please see article below)

Texas Identifies Case of COVID-19 Omicron Variant

News Release

Dec. 6, 2021

The first known Texas case of the COVID-19 B.1.1.529 variant has been identified in a resident of Harris County. The adult female resident was recently diagnosed with COVID-19. Results of genetic sequencing this week showed that the infection was caused by the Omicron variant strain. The case is being investigated by Harris County Public Health and the Texas Department of State Health Services.

“It’s normal for viruses to mutate, and given how quickly Omicron spread in southern Africa, we’re not surprised that it showed up here,” said Dr. John Hellerstedt, DSHS commissioner. “Getting vaccinated and continuing to use prevention strategies, including wearing a mask when you are around people you don’t live with, social distancing, handwashing and getting tested when you have symptoms, will help slow the spread of the virus and help end the pandemic.”

The B.1.1.529 variant was identified in South Africa last month and appears to spread more easily from person to person than most strains of the coronavirus. Currently, it is unclear if the Omicron variant is associated with more severe disease. Studies have commenced to determine how effective vaccines are expected to be against infection. However, vaccination is expected to continue to offer protection against hospitalization and death. Omicron is thought to be responsible for a small proportion of the current COVID-19 cases in Texas and the United States.

Vaccination remains the best protection against serious illness and death from COVID-19. Everyone 5 years and older is eligible for vaccination, and everyone 18 years and older should get a booster shot when they are eligible. The latest on COVID-19 in Texas is available at dshs.texas.gov/coronavirus, including daily case data and information on testing and vaccination.

HHS

Corona Virus Testing and Testing Information (Includes videos and information about finding testing locations near you and home-testing as well)

DSHS

Below are frequently asked questions (FAQs) about the variants of COVID-19, including the Delta and Omicron variants.

How can I tell if I have the Delta or Omicron variant? Do labs report that to the state?

That information may not be readily available. The viral tests that are used to determine if a person has COVID-19 are not designed to tell you what variant is causing the infection. Identifying COVID-19 variants requires a special type of testing called genomic sequencing. Due to the volume of COVID-19 cases, sequencing is not performed on all viral samples. However, because the Omicron variant now accounts for the majority of COVID-19 cases in the United States, there is a strong likelihood that a positive test result indicates infection with the Omicron variant.

Are the symptoms different for the Delta or Omicron variant? If so, what are they?

Because Delta and Omicron are variants of the same virus—SARS-CoV-2, the virus that causes COVID 19—the symptoms and the emergency warning signs are the same. However, some variants may spread more easily or may cause more severe symptoms and illness. Because of this, scientists are actively monitoring and studying new variants to learn more about how easily they spread, whether they make people more or less sick, and how well they respond to existing vaccines, treatments, and tests.

Is Texas tracking variants of COVID-19?

Yes. Public health officials at the federal, state, and local levels continue to study variants, monitor their spread, develop strategies to slow their spread, and test how variants may respond to existing therapies, vaccines, and testing. For information on variants of concern in Texas, see the Variants and Genomic Surveillance for SARS-CoV-2 in Texas section of the DSHS website.

Who is most at risk of contracting a variant of COVID-19?

Unvaccinated people are most at risk of contracting COVID-19, including any of its variants. The Delta and Omicron variants are more aggressive than other known variants and spread most rapidly in communities with fewer fully vaccinated people.

The absolute best protection for yourself and those close to you is getting fully vaccinated. The vaccine is proven to safely protect you from COVID-19’s worst effects and lowers your chances of spreading the virus. Greatly increasing the number of fully vaccinated Texans is the only way to prevent a devastating rise in the spread of the pandemic virus.

Are the newer variants worse than the early COVID-19 strains? Will a variant make me sicker than previous strains?

Omicron appears to spread much more easily than other known variants, which means it’s more contagious than other variants. We are still learning whether Omicron may put infected people at higher or lower risk of hospitalization than other variants.

What’s the treatment for patients with the Delta or Omicron variant?

There are different treatment options available for all COVID-19 variants, but some treatments may be more effective for certain variants. In many cases, treatments are reserved for certain high-risk groups. If you or a loved one is sick, check with your healthcare provider about your specific case.

What is the current travel guidance?

Travel recommendations may vary depending on whether you are fully vaccinated or not. Some travel destinations may have different requirements for vaccinated and unvaccinated travelers.

Keep in mind that travel and other guidance may change as we learn more about the virus variants and breakthrough cases. Stay up to date with CDC travel recommendations by visiting the Travel page of the CDC website.

Are people of certain ages at higher risk for infection with the newer variants?

Yes. Anyone who is not fully vaccinated is at greater risk of getting COVID-19. Children up to 5 years old are not yet eligible to receive the COVID-19 vaccine. Anyone who is old enough and able to get the vaccine should do so to protect those who are unable to get it, as well as those for whom the vaccine is less protective. That includes children under age 5 and people with certain medical conditions. It’s also important for those people who qualify to get the booster dose, too.

How many known variants are there?

There are many. Because viruses constantly change through mutation, new variants occur all the time. Sometimes they disappear, and sometimes they persist. Variants are classified in four ways, from least to most severe: Variants Being Monitored, Variants of Interest, Variants of Concern, and Variants of High Consequence.

Public health officials are currently studying two that are classified as Variants of Concern: Delta and Omicron. These are variants that show evidence of an increase in transmissibility, more severe disease (increased hospitalizations or deaths), and/or reduced effectiveness of tests, treatments, or vaccines.

In the U.S., there are currently many Variants Being Monitored, but no Variants of Interest or Variants of High Consequence.

To learn more about variants in the U.S., visit the About Variants of the Virus, Variant Classification, and Variant Surveillance pages on the CDC website.

What are the differences between the variants?

Variants vary by their genetic markers. These differences in genetic markers may affect how easily the virus is spread, the severity of illness, how well existing tests can detect the virus, the effectiveness of treatments and vaccines, and more.

Each variant is slightly different. Think of variants like branches on a tree. Each branch is slightly different than others on the tree, but they have similarities, too. Scientists study the differences in COVID-19 variants, so they can label and track them according to those differences.

Do the vaccines protect against the Omicron variant?

Early data suggest that the available vaccines are effective against severe disease and hospitalization caused by the Omicron variant. The best protection against any COVID‑19 variant is getting fully vaccinated. And a booster dose of vaccine is a proven way to maximize the protection against infection and severe disease.

Which vaccine provides better protection against the virus?

In mid-December 2021, CDC updated their vaccine recommendations with a preference for mRNA vaccine (Pfizer and Moderna) over the Johnson & Johnson (J&J) vaccine. However, public health experts continue to say that getting any vaccine is better than being unvaccinated. J&J vaccine will remain available for people who are unable or unwilling to get an mRNA vaccine.

Read CDC’s media statement to learn more about the updated vaccine recommendations.

Keep in mind that guidance may change as we learn more about the virus variants. DSHS will update information as it becomes available.

LTC Regulatory Services

Incident Reporting

HHS regulated providers can self-report incidents affecting resident health/safety, including issues related to COVID-19, online to the Health and Human Services Commission or by calling 1-800-458-9858.

- Incidents Submission Portal for Long-term Care providers

- Incidents Submission Portal for Health Care Quality providers

Intermediate Care Facilities (ICF/IID)

- ICF/IID Provider COVID-19 Vaccination Data Reporting Rule (PDF)

- ICF/IID COVID-19 Expansion of Reopening Visitation Emergency Rule (PDF)

- ICF/IID COVID-19 Response Emergency Rule (PDF)

- COVID-19 Response for ICF/IIDs (PDF)

- Frequently Asked Questions for ICF/IIDs (PDF)

Home and Community-based Services (HCS) and Texas Home Living (TxHmL)

Revised Guidance for LTC Facilities Experiencing COVID-19 Staffing Shortages

Revised Guidance on Staff Work Restrictions and Return to Work

HHSC has issued revised guidance for long-term care providers experiencing staffing shortages due to COVID-19. The requirement to contact LTCR before implementing CDC guidance on staff work restrictions and return-to-work has been removed.

“Guidance and Protocol for Long-Term Care Facilities Experiencing Staffing Shortages due to the COVID-19 Public Health Emergency.

This checklist provides guidance for long-term care facilities and residential providers facing staffing shortages related to the COVID-19 public health emergency.

This checklist incorporates CDC guidance with state and federal staffing requirements.

Facilities facing staffing shortages must use this checklist before requesting emergency staffing resources. The CDC’s mitigation strategies are meant to be implemented sequentially (i.e., contingency strategies before crisis strategies). The conventional strategies must be followed when the facility has adequate staffing.

As a reminder, facilities are required to cohort residents based on their COVID-19 status: COVID-19 negative (COVID-negative), COVID-19 positive (COVID-positive), and unknown COVID-19 status (COVID-unknown).1 Healthcare personnel (HCP) are considered “boosted” if they have received all COVID-19 vaccine doses, including a booster dose, as recommended by CDC.”

For more…. Read the updated guidance.

LTC (Long Term Care) Online Portal BasicsWebpage

January 9th, 2022

Please click on link below to take you to the “LTC Online Portal Basics” page with important information on usages for the portal, e-learning training sessions, and pdfs of manuals needed for navigating the portal

This interactive training provides a basic overview of the Long Term Care (LTC) Online Portal including an overview of the features of the blue navigational bar and the yellow Form Actions bar. Demonstrations and simulations are available to provide opportunities for hands-on experience. For program-specific details of the features discussed, you will be referred to the CBT or User Guide for your LTC program.

Length: Modules vary from 2 to 20 minutes

When you have completed this CBT, you should be able to:

-

- Follow the requirements for obtaining and using a National Provider Identifier (NPI) or Atypical Provider Identifier (API);

- Log in to the LTC Online Portal;

- Create an administrator account on the LTC Online Portal;

- Use the features of the blue navigational bar;

- Use the features of the yellow Form Actions bar; and

- Understand general information for the LTC Online Portal, including:

- Required fields;

- Unlocking forms;

- Entering dates;

- History trail;

- Error messages; and

- Time-out.

Below are some helpful PDF’s

Accessible PDFs

-

-

Accessible PDF: LTC Online Portal Basics – Main

Accessible PDF: LTC Online Portal Basics – Introduction

Accessible PDF: LTC Online Portal Basics – Create Administration Account

Accessible PDF: LTC Online Portal Basics – Create Administration Account – Simulation

Accessible PDF: LTC Online Portal Basics – Logging In

Accessible PDF: LTC Online Portal Basics – My Account

Accessible PDF: LTC Online Portal Basics – Blue Navigation Bar

Accessible PDF: LTC Online Portal Basics – Submit Forms – Demonstration

Accessible PDF: LTC Online Portal Basics – FSI – Demonstration

Accessible PDF: LTC Online Portal Basics – FSI – Simulation

Accessible PDF: LTC Online Portal Basics – Vendors – Demonstration

Accessible PDF: LTC Online Portal Basics – Current Activity – Demonstration

Accessible PDF: LTC Online Portal Basics – Drafts – Demonstration

Accessible PDF: LTC Online Portal Basics – Printable Forms – Demonstration

Accessible PDF: LTC Online Portal Basics – Alerts – Demonstration

Accessible PDF: LTC Online Portal Basics – Yellow Form Actions Bar

Accessible PDF: LTC Online Portal Basics – Add Note – Demonstration

Accessible PDF: LTC Online Portal Basics – Correct This Form – Demonstration

Accessible PDF: LTC Online Portal Basics – Inactivate Form – Demonstration

Accessible PDF: LTC Online Portal Basics – Print Menu – Demonstration

-

HCS Provider Applicant- Provider Applicant Training (PAT) and Test Information Update

“Study & Prep Session For HCS Provider Applicant Test”

Contact us for a copy of pre-recorded session from November 3rd, 2021

This Training is Not Affiliated In Any Way with HHSC

It is Provided by Twogether Consulting, a private consulting company for HCS/TxHmL & ICF providers (As well as persons seeking Information about these Medicaid programs)

(We will be reviewing some TxHmL information as well)

Cost: $150/person

To register, please go to:

Topics:

Description of HCS & TxHmL Waivers and Basic Terminology Needed

Tips for Preparing For The HCS Provider Certification Test.

Important Sections of the HCS & TxHmL Handbook and Interpretive Guidance Booklet,

Frequently Asked Questions found on the HHSC HCS/TxHmL home pages.

Frequently Cited TAC Codes (HCS & TxHmL)

How to Access Important Information on the HHSC Website: Joint Training Opportunities, HCS/TxHmL Waiver Training, Resources, Contact Information, etc..

Information on Person-Centered Training Opportunities and The Importance of This Training

What Happens After I Pass My Test?

HCS Practice Test during the session, so that you may become comfortable with the type of questions that may be asked during the PAT testing session

Don’t forget to study for your test!!!

Links to TAC (Texas Administrative Codes) provided below to Study

HCS https://texreg.sos.state.tx.us/public/readtac$ext.ViewTAC?tac_view=5&ti=40&pt=1&ch=9&sch=D&rl=Y

TxHmL: https://texreg.sos.state.tx.us/public/readtac$ext.ViewTAC?tac_view=5&ti=40&pt=1&ch=9&sch=N&rl=Y

HCS/TxHmL-Provider Applicant Test Study Material (Update)

Some additional helpful study material prior to taking the HCS Provider Applicant Test, are listed below.

HCS/TxHmL Interpretive Guidance Booklet (as Required byHouse Bill (H.B.) 3720, 87thLegislature, 2021)

This guidance booklet was meant to assist providers and surveyors with surveyor expectations and considerations when handing out administrative penalties for violations of the certification principles

HCS & TxHmL Joint Training Opportunities HHSC website page (Please see free webinars that review the 9 major certification principles from the HCS TAC code. These principles are also noted in the HCS Handbook and the new Interpretive Guidance Booklet)

For additional information on the Joint Training Opportunities webinars or requesting a link to pre-recorded webinars you may have missed, please email LTCRJointTraining@hhs.texas.gov

*In addition don’t forget the primary study material is the: HCS Handbook, the HCS TAC, and for TxHmL TAC for those also taking the TxHmL test.

“My application was accepted to become an HCS &/or TxHmL Waiver Provider, now what do I do?”

Once your Contract Manager has informed you via email of your approved application, you will receive an email approving your application with a link to the HHS Portal, and the Program Manager will have to create an account to complete the training. Please contact IDDWaiverContractEnrollment@hhsc.state.tx.us, or call 512-438-3234 to confirm with your assigned Contract Manager.

• Once you set up your new account, find and select the Medicaid Long Term Services and Support Training under “Course Categories.”

• Select the Provider Applicant Training (PAT) link. The training is compiled in three different steps. Helpful tips are available on this page.

Step 1: Important to know Before you Get Started

Step 2: Training Modules

➢ Each module must be completed to advance to the next module.

Step 3: Evaluation and Certificate

➢ Complete the mandatory survey to gain access to the Provider Applicant Training Certificate

➢ Make sure to save your certificate of completion

➢ You will be notified via email of your test dates

There are 12 modules.

How long can I take to complete the training?

The training can be completed at your own pace.

You will have 40 minutes to complete the test. No additional time will be allotted.

Yes, but only within the 40 minutes allotted.

The system will grade your test immediately after completing it.

Your HHS Contract Manager will contact you via email to explain the next steps, which will include scheduling a pre-award site visit.

Is there a retake if I failed the test?

There will be two opportunities to take the test. If you fail a second time you will be required to retake the training

If you do not pass the third test attempt, please submit a new application if you would still like to become a provider.

HCS Provider Applicant- Provider Applicant Training (PAT) and Test

Start studying now, if you haven’t already!!

Remember to get prepared and please study. You may have been waiting a long time to test, but I know that applicants sometimes don’t study as much as they need to, to take the test. If you have come this far, you do not want to fail the test and have to start all over again! Please contact us if you need help in preparing for the test. We do provide services such as study prep sessions, practice tests, etc…

Be sure to study the HCS Handbook and the Texas Administrative Codes for HCS (& TxHmL if you applied for this certification as well). See links below:

Go to this site. These sections are the HCS Handbook and are a “non-legalize” explanation of the HCS Texas Administrative Code. They also tell you who is responsible for what. LIDDA Vs. Provider. But your specific questions for the test will most likely be coming from the HCS TAC code. This is just a better explanation to make you understand those rules.

https://hhs.texas.gov/laws-regulations/handbooks/home-community-based-services-handbook

New Revised TAC (Texas Administrative Code) for HCS

(Home & Community Based Services) was put into effect in October 2019.

Title 40 Part 1 Chapter 9 Subchapter D

https://texreg.sos.state.tx.us/public/readtac$ext.ViewTAC?tac_view=5&ti=40&pt=1&ch=9&sch=D&rl=Y

Section 9.151 through 9.192.

New Revised TAC (Texas Administrative Code) for TxHmL

(Texas Home Living Waiver was put into effect in October 2019.

https://texreg.sos.state.tx.us/public/readtac$ext.ViewTAC?tac_view=5&ti=40&pt=1&ch=9&sch=N&rl=Y

Title 40 Part 1 Chapter 9 Subchapter N

Section 9.551 through 9.587

Important-HCS and TxHmL Webinars and Claim Payment Account Setup (Coming Soon!)

HCS and TxHmL program providers, Local Intellectual and Developmental Disability Authority agencies, and Financial Management Services Agencies billing on behalf of Consumer Directed Services employers can register for webinars starting next month. These webinars will cover information about the Long-Term Care Online Portal and forms that HCS and TxHmL program providers will use.

The webinars will:

- Include a live Q&A session

- Begin in February 2022

Details, including dates, times, and registration links will be in a future article on the Texas Medicaid & Healthcare Partnership website. Providers should check the Recent News section of the LTC webpage often for current information.

HCS and TxHmL program providers, LIDDAs, and FMSAs will begin submitting claims and forms to TMHP on March 1, 2022. Program providers, LIDDAs, and FMSAs should set up the following accounts, if not yet done:

- One of the following for Claims Submission Account:

- TexMedConnect

- Electronic Data Interchange

- LTC Online Portal

- TMHP Learning Management System

Failure to set up the necessary accounts can lead to payment delays after March 1, 2022. Program providers, LIDDAs, and FMSAs can find resources for creating the necessary accounts and the time frames it could take to create those accounts linked below.

- TexMedConnect allows users to submit claims and can take up to 10 days. LTC Online Portal allows users to submit, view, and manage forms. Account setup can take up to three days. The TMHP Account Setup for HCS and TxHmL Waiver Programs (PDF) is the available resource.

- EDI allows users to submit claims through a third-party submitter or a provider’s own software. Account setup can take up to 30 days. Access the updated 837P LTC Companion Guide Now Available for HCS and TxHmL Program Claims Submission Practice.

- TMHP LMS allows users access to important TMHP training materials and that takes one day. LMS Registration and Navigation Job Aid for Providers (PDF) is the resource.

Providers can refer to the HCS and TxHmL Waiver Programs Frequently Asked Questions (FAQ) or contact the TMHP EDI Help Desk at 888-863-3638 with questions.

HHSC Publishes Active, Unemployable Work-Around (Provider Letter 2021-44)

December 20th, 2021

Check LEIE/OIG and check With the implementation of FBI-based fingerprinting in 2021, Long-term Care Regulation (LTCR) also implemented Occupations Code (OC), Chapter 53, related to the consequences of a criminal conviction, specifically the 2019 legislative update to OC §53.023 concerning additional factors for licensing authorities to consider after determining a conviction directly relates to the occupation.

Policy Details & Provider Responsibilities Long-term care facilities and agencies must check and continue to check an applicant’s criminal history, Nurse Aide Registry status, and Employee Misconduct Registry. Use the HHSC Employability Status Search at https://emr.dads.state.tx.us/DadsEMRWeb/ (link is external), which includes information regarding Sanctions. OC § 53 requires an employer to consider only convictions directly related to the occupation.

PL 2021-44

With this new implementation, it is possible for an individual to receive a license, permit, or certification who is not employable or only employable in limited settings according to Health and Safety Code (HSC) §250.006.

Beginning December 20, 2021, long-term care facilities and agencies must also check the Excel document linked below to determine if an individual is licensed/permitted/certified but is unemployable in one or more long-term care settings licensed by LTCR. This file contains the names of nursing facility administrators, nurse aides, and medication aides that have active licenses/permits/certifications but are unemployable according HSC §250.006 in one or more long-term care settings.

https://www.hhs.texas.gov/sites/default/files/documents/active-unemployable.xlsx

HHS is updating the Employability Search with information on active but employable individuals. Until this update is complete, providers will be required, in addition to checking the Employability Search, to check the Active but unemployable Excel File in the resources section of this Provider Letter.

Resources Active but unemployable Excel File

Contact Information

If you have any questions about this letter, please contact the Policy and Rules Section by email at LTCRPolicy@hhs.texas.gov or call (512) 438-3161.

SB8- New HHSC Grants Webpage

December 17th, 2021

The link doesn’t inform providers about current information but will provide future information about ARPA funds, and will be available on the newly created HHSC Grants webpage.

Press Release: Governor Abbott, HHSC Announce $128 Million To Support Staffing Needs At Rural Hospitals, Nursing Facilities | Office of the Texas Governor | Greg Abbott

HHSC Grants Webpage: COVID-19 in Healthcare Relief Grants | Texas Health and Human Services

According to the HHSC Provider Finance representative- Ms. Ellison at LTCR Dec. 7th meeting with the IDD workgroup, this is the information on how the state-controlled ARPA funds appropriated via SB 8 (3rd Special Session) will be distributed. [Remember: These funds are separate from the HCBS 10% FMAP funds.]

- ALFs: 2.025 facilities

- ICF/IID: 708 facilities

- Home Health: 6,945 (count based on on number of unique entities/facilities listed as HCSSA)

- Community Attendants which will be separated into 2 groups – CDS and non-CDS: 23,494 CDS providers; 3,498 non-CDS and based on billing data.

Transition of DH to ISS

December 12th, 2021

ISS (Individualized Skills and Socialization)

Changes to Day Habilitation (DH) programs are coming for HCS/TxHmL! The link below contains a discussion concerning the implementation of a recommendation in the Rider 21 Report (General Appropriations Act for FY 2020-2021, 86th Session) related to the monitoring of DH programs which will transition to the provision of ISS.

To view, the report go to: https://www.hhs.texas.gov/sites/default/files/documents/laws-regulations/reports-presentations/2021/rider-21-transition-day-habilitation-services-jan-2021.pdf

- Current DAHS providers who want to also provide ISS.

- HCS/TxHmL providers operating a DH and serve persons eligible to receive ISS.

- Independent DH providers serving persons eligible to receive ISS.

- ICF/IID providers who operate a DH and only serve persons receiving ICF/IID services will not be required to obtain the license. However, if the ICF/IID provider opens its DH program to serve persons eligible to receive ISS, such as persons enrolled in HCS/TxHmL, it will need to obtain the license.

HHSC E-Learning Portal

The HHS Learning Portal

Please bookmark the new location or click here and save to “Favorites”

The new web address for the HHS Learning Portal is: https://learningportal.hhs.texas.gov

New & Current HCS/TxHmL Providers, Please Take These Trainings

These are the courses that are really applicable to HCS/TxHmL providers below and they are all free. Click on them to go directly to these pages:

Following Suspensions Still In Place Related To COVID-19 (HCS): Recap

November 23rd, 2021

While most of the suspensions related to COVID-19 have ended, the following HCS suspensions are still in place.

- HHSC will still allow an HCS four-person residence to add up to two additional individuals temporarily if the residence has the space to accommodate them and has been approved as a four-person residence by HHSC. (Rule: 40 TAC §9.153(39)(B))

- Suspension of the requirement for HCS providers to ensure at least one complete staff shift change per day for individuals receiving residential support. (Rule: §9.174(a)(38)(C))

- Suspension of the requirement for day habilitation to be provided in accordance with the individual’s person-directed plan, individual plan of care, implementation plan, and Appendix C of the HCS Program waiver application. (Rule: §9.174(a)(28))

- In Relation To a recent alert from HHSC concerning “Background Checks”: 40 TAC 9.177(n) states “The program provider must comply with §49.304 of this title (relating to Background Checks).” This rule has not been waived and is still required.

- Concerning IPC’s & IDRC’s and signatures, I have verified with LTCR (Long-Term Care & Regulatroy) policy department the following: The policy letter you will need to reference is IL 2020-45 and it is currently still valid.

According to HHSC, a service coordinator or program provider is not required to obtain signatures of the individual or LAR on an IPC renewal/revision or on supporting documentation. However, the program provider or LIDDA service coordinator must obtain an oral agreement from the individual or LAR about the IPC renewal/revision and supporting documentation and document the oral agreement in the individual’s record. A program provider or LIDDA service coordinator must obtain the signature of a person, other than the individual or LAR, who is required to sign the IPC renewal/revision or supporting documentation.

For more information regarding the End of Temporary Suspension of Certain LTCR Requirements During COVID-19 Outbreak please see Provider Letter 2021-29.

Recording Available -11-10-21: HCS, TxHmL, CLASS, DBMD Webinar

November 10, 2021, HCS, TxHmL, CLASS, DBMD Webinar Recording Available

A recording of the November 10, 2021, Home and Community-based Services (HCS), Texas Home Living (TxHmL), Community Living Assistance and Support Services (CLASS), and Deaf-blind Multiple Disabilities (DBMD) Webinar with Texas Health and Human Services Commission (HHSC) Long-term Services and Supports is available for those who could not attend.

Ways To Assist Providers Currently Using TASKMASTER PRO “Cloud-Based” Services (HCS/TxHmL/ICF/CLASS)

As some of you may know, Twogether Consulting does not work for Taskmaster Pro, but we do have quite a bit of experience with their software and I love the benefits of this “cloud-based” program. In the past, I have also used the software for my own HCS program as we had HCS contracts in over 32 counties. Electronic Records were a must for us with that many counties to keep track of and service providers to monitor! No matter who you choose to provide those services. I do, however, highly recommend that if you currently do not have any type of electronic records system that you might want to start thinking about it, especially if you do have lots of area to cover or a large number of individuals in your program. There are a couple of other programs out there I like and we help providers regardless of what they have chosen to put in place I am no longer an HCS provider myself, as I am so busy with Twogether Consulting, lol but I certainly enjoy helping our clients using TMP.

Currently, we do provide quality assurance to providers in Texas and some out of state. Twogether Consulting often provides additional webinars, training, and assistance for providers who are receiving services from TaskMaster Pro software to help them implement their nursing programs more efficiently with TMP’s great tools. We can also assist providers with getting the most out of your TMP software for facility quality assurance. Typically quality assurance plans are quarterly and/or as needed for example. We provide mentoring for new Case Managers, Q’s, and Nurses, using the TMP software. This can be done off-site and therefore is more cost-effective for the provider.

New: We can also schedule additional 1-on-1 or facility-specific training sessions to help your agency better utilize TaskMaster Pro for coordination of client services, monitoring, and documenting in (HCS, TxHmL, ICF, other IDD/DD waivers)

New: We can develop training content (ppts., handouts, tests, etc..) catered to your agency for your Direct Support Staff, Case Management, QIDP and Nursing staff (i.e. Direct Support Staff Documentation, Policies & Procedures and more.) The facility would be able to keep this training and upload it to the “Training Library” (i.e new hire or annual training)

*Disclaimer: the services mentioned above are not associated with any training, IT support, maintenance, or other services you are receiving directly through Taskmaster Pro or as a condition agreed to in your contract with TaskMaster Pro. These are outside services and are provided solely through Twogether Consulting.

For those of you who are interested in getting more information about Taskmaster Pro or purchasing the software and do not currently have electronic health records, we can provide a free demo after you sign a non-disclosure form, or we can definitely direct you to someone from TMP to provide the demo and assist you with information on the cost and purchasing the software as we do not work for TMP.

Contact us at info@twogetherconsulting.com or on our contact page: to request other services mentioned above!

See Taskmaster Pro Info below from the website.

Developed by a provider for providers!

TaskMaster Pro is a web-based cloud computing system designed specifically for managing Waiver and ICF/DD programs. TaskMaster Pro was created by Larry Hill of Hill Resources in Abilene and his team. Through the internet, you will be able to access information and monitor activity from wherever you are and whenever you want and when regulatory changes occur or required forms are updated, TaskMaster Pro is updated so it will never be obsolete. Now, this user-friendly, integrated system is available to you.

Request a TaskMaster Pro Demonstration

Manage your program anytime and from anywhere in the world with TaskMaster Pro!

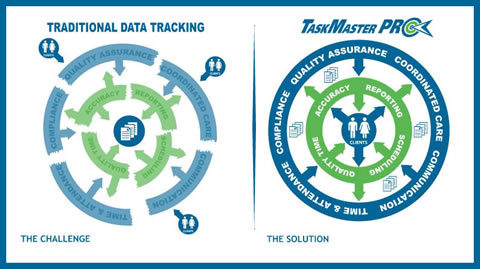

The Challenge

With traditional data tracking systems, a heavy emphasis is placed on regulatory guidelines which shift the focus of the direct care providers to that of compliance. This shift causes a break in the flow of quality care and leaves the clients with impersonal care and creates fragmentation in the system.

The Solution

TMP streamlines regulatory compliance by helping to automate the quality assurance processes. In turn, this improves the reporting accuracy of direct care providers and increases overall efficiency. The flow of information is orderly and dynamic allowing for improved client care and improved operations.

-

- Secure Communication Center

-

- Person-Centered Planning

-

- Program Planning for QIDPs (QDDPs, QMRPs), Case Managers, and Program Managers

-

- Complete Medical Module

-

- Psychological/Behavioral Module

-

- Service Delivery Log/Billing Waivers

-

- Client Budget

-

- Direct Care Reporting

-

- Incident/Accident Reporting

-

- Scheduling

-

- Report Tracking

-

- Human Resources

-

- Staff Development and Training Module

-

- Time and Attendance

-

- Electronic Data Signature

-

- Web-Based Cloud Computing

-

- Off-Site Secure Hosting

-

- Automated File Backup

-

- Customizable Access Control

Texas Lawsuits Filed Against COVID-19 Vaccine Mandate Now Includes Challenge To CMS Federal Contractor Rules

PEM (Provider Enrollment Management) System

November 16th, 2021

Starting August 2021, HHSC has begun the transition to one system for Provider Enrollment Management which will move to 1 “smart system” if you want to become a Medicaid vendor/Medicaid provider, re-enrollment every 5 years, and the forms/application will be uniform. They will go directly into TMHP system, not to HHSC. The current paper application forms will not be required. They have begun the process with existing providers.

One system=PEMS

One NPI-based enrollment

One dynamic smart application (no paper)

One dynamic smart provider agreement

One standardized set of enrollment forms

One provider message board

In Summary:

Providers will be enrolling through PEMS online application, no more paper applications. You will no longer enroll through HHSC, the application will go directly to TMHP

IDD providers may recall that in 2015 legacy DADS issued a notice that Medicaid providers had to enroll or re-enroll in Medicaid by March 24, 2016, and every 5 years thereafter. At the time, the process required payment of an application fee that was sent to legacy DADS. Providers were informed, that as a result, the PHE, revalidation was postponed, and that changes to the process were forthcoming (in particular, that the application process would be completed through a TMHP portal).

Effective February 28, 2022 HHSC is ending the flexibility that extended revalidation dates due during the PHE.

- Providers that were due for revalidation effective March 1, 2020 through February 28, 2022 will be given a post-PHE grace period to complete the revalidation process. TMHP will notify providers in January 2022 of their recalculated enrollment end date and again 120 days prior to their enrollment end date.

- A webinar to review the process will be held December 7, 2021. See registration link below.

- The system/portal will go live December 13, 2021.

-

Register for the December 7th webinar: https://www.tmhp.com/news/2021-11-05-register-now-pems-provider-webinar

-

Other Resources/Notices:

https://www.tmhp.com/news/2021-10-29-coming-soon-tmhp-provider-enrollment-and-management-system-pems

https://www.tmhp.com/news/2021-10-13-coming-soon-tmhp-provider-enrollment-and-management-system-pems

https://www.tmhp.com/news/2021-09-24-coming-soon-tmhp-provider-enrollment-and-management-system-pems

Reminder: LTC Providers May Request COVID-19 Emergency Support

November 6th, 2021

LTC Providers May Request COVID-19 Emergency Support

For Emergency Staffing Support:

The Office of the Governor directed DSHS to use staffing agencies to provide medical personnel from out-of-state to Texas health care facilities to assist in COVID-19 operations.

This support will be available to residential long-term care providers.

-Providers must demonstrate that they have exhausted all other options.

-Also that they have urgent need for assistance before requesting emergency staffing support.

The State is asking that jurisdictions and health care entities be judicious with requests for staffing, as the State will not be able to address all staffing needs, especially as the need for emergency staffing ramps up across the state.

LTC providers are always required to provide services to residents or clients before, during and after an emergency.

The emergency plan must include:

- Planning for staff shortages

- A back-up plan to ensure operations and care of residents continues

For COVID-19 Vaccination, Testing Kits, PPE, Disinfection, and HAI/EPI Support:

Long-term care providers can request:

- COVID-19 mobile vaccine clinics for residents and staff

- BinaxNow testing kits. Read PL 2020-49 for details.

- PPE (providers should exhaust all other options before request)

- Facility cleaning and disinfection

- Healthcare-associated infection and epidemiological support

To Request Support:

To initiate a request for COVID-19 support described above, contact the HHSC LTCR Regional Director in the region where the facility is located.

HHSC LTCR staff are responsible for initiating a State of Texas Assistance Request on behalf of the long-term care provider.

HHSC LTCR staff may request supporting documentation to verify need.

CMS and OSHA Issue Temporary Interim Rules on the Vaccine Mandate

- Link to Interim Final Rules and FAQs (scroll to bottom of page): https://www.cms.gov/newsroom/press-releases/biden-harris-administration-issues-emergency-regulation-requiring-covid-19-vaccination-health-care

- CMS is hosting national call/webinar Nov. 4th at 2:00 ET: https://cms.zoomgov.com/webinar/register/WN_7IlEgLznTIm3sqAsv3nHZw

- Link to interim rules: https://public-inspection.federalregister.gov/2021-23643.pdf

- Link to webinar on YouTube: https://www.youtube.com/watch?v=ixxkn3Y8z6g&ab_channel=USDepartmentofLabor

- Link to FAQs: https://www.osha.gov/coronavirus/ets2/faqs

HHSC Publishes Acceptable Documentation for a Criminal History Check for Contractors (IL 2021-48)

HHSC Publishes Acceptable Documentation for a Criminal History Check for Contractors (IL 2021-48)

HHSC has published IL 2021-48 (PDF).

This letter is provided as a companion letter to PL 2019-01 (PDF) which describes acceptable documentation a contractor may use to demonstrate the contractor conducted a criminal history check of an employment applicant or an employee. Licensed contractors must continue to follow the guidance outlined in PL 2019-01. Unlicensed contractors must follow the guidance in this information letter.

For questions about this information letter, please contact LTSSpolicy@hhs.texas.gov

HHSC Publishes Information to Assist People with Terminated SSI (IL 2021-47)

HHSC Publishes Information to Assist People with Terminated SSI (IL 2021-47)

HHSC has published IL 2021-47 (PDF).

It assists people with terminated Supplemental Security Income. In Texas, people who get Supplemental Security Income benefits are eligible for Medicaid. Under normal circumstances, termination of SSI benefits results in losing Medicaid coverage. When the continuous Medicaid coverage period ends, these individuals will lose their Medicaid coverage unless their SSI benefits are reinstated they are found eligible for Medicaid under other criteria. If Medicaid coverage ends for an individual enrolled in a waiver program, their waiver program services will also end.

Following the declaration of a federal PHE (public health emergency) on Jan. 27, 2020, federal guidance allows HHSC to maintain Medicaid coverage for people who lose their SSI benefits.

●They are no longer eligible for Medicaid because they have lost their SSI benefits, but they still have Medicaid coverage due to the current PHE.

●Applying to have SSI reinstated by the SSA . ●Applying for Medicaid for the Elderly and People with Disabilities using Form H1200 and Form 1746-A.

Service coordinators and case managers should also encourage individuals to report changes in their circumstances to HHSC, even during the PHE, to ensure contact and eligibility information remains accurate. These changes may include changes of address, phone number, or pregnancy status. Individuals may report changes online at www.yourtexasbenefits.com, by calling 2-1-1, or by contacting a local HHSC benefits office

From Our Friends At The ARC of TEXAS: Update on Disability Voting Rights & Virtual Support Group For Persons With Disabilities

|

Vote early in Texas through Friday, October 29

|

|

| DOWNLOAD CHECKLIST | |

|

|

Join the next Virtual Support Group meeting

|

|

| READ MORE | |

|

SB 8 (ARPA funds) Passed by the Senate and House!

October 18th, 2021

- Pages 3-24 contain the committee report in bill language. To view bill language related to the one-time direct care recruitment and retention payments, see Section 33, pages 22-24.

- Pages 25 – 75 reflect the conference committee decisions. To view decisions specific to retention and recruitment payments, see Section 15, beginning at the bottom of page 45. The first column reflects the Senate’s version of SB 8; the middle column the House’s version; the last column the conference committee decisions

- Pages 76-77 provide the bill’s fiscal note.

HCS/TxHmL Interpretive Guidance Page With Tools For Rule Interpretations

October 3rd, 2021

HHSC Announces HCS and TxHmL Interpretive Guidance Page

HHSC Long-term Care Regulation created the HCS and TxHmL Interpretive Guidance page. This page connects program providers with relevant tools for rule interpretation. It includes the Interpretative Guidance booklet and Certification Principle training.

October 3rd, 2021

Twogether Consulting highly recommends you read through the HCS/TxHmL Interpretive Guidance Booklet and keep this PDF downloaded on your desktop for reference in preparation for survey and for addressing Plans of Corrections after your survey. This guidance is meant to give you information on what surveyors expect to see when coming to your facility as well as examples of critical vs. non-critical scenarios to help you identify the type of Administrative (monetary) penalties you may incur due to violations (previously citations) made concerning the HCS/TxHmL TAC rules and regs. It is extremely helpful (especially concerning nursing requirements and expectations).

HHSC Publishes Amended Statutory Cap Regarding Administrative Penalties for ICFs (PL 21-34)

September 30th, 2021

![]() CAP Update: Administrative Penalties for ICFs (PL 21-34)

CAP Update: Administrative Penalties for ICFs (PL 21-34)

HHSC published Provider Letter 21-34 Amended Statutory Cap Regarding Administrative Penalties for Intermediate Care Facilities. PL 21-34 notifies providers of changes to how HHSC determines and imposes administrative penalties based on changes made by House Bill 3720 (87th Legislature, Regular Session, 2021).

COVID Vaccine Information- HCS, TxHmL, ICF

September 21st, 2021

Updated CDC Guidance for LTC Facilities on Accessing COVID-19 Vaccine – Sept. 2021

The Centers for Disease Control and Prevention has recently updated resources for long-term care facilities on how to help residents and staff access COVID-19 vaccines:

- Vaccine Access in Long-term Care Settings

- Care Administrators and Managers: Options for Coordinating Access to COVID-19 Vaccines

- Jurisdictions Can Ensure COVID-19 Vaccine Access for Staff and Residents in Long-term Care Settings

September 21st, 2021

COVID-19 Vaccine Status Not a Requirement for Services

In accordance with Governor Abbott’s Executive Order No. GA-39, providers must not require clients to provide documentation of their COVID-19 vaccine status as a condition to receive any Texas Medicaid service.

September 15th, 2021

Update: Getting COVID-19 Vaccines-ICF/IID

Nursing, assisted living, and intermediate care facility staff and residents who want to receive the first, second or third dose of the COVID-19 vaccine may use the options below.

Contact the HHSC LTCR Regional Director in the region where the facility is located. Request a mobile vaccination clinic at your facility. The mobile vaccination clinic can administer first, second, or third doses of the COVID-19 vaccine to residents and staff. Facilities may need to make alternate arrangements for staff and residents to receive any more doses after the vaccination clinic.

Enroll as a DSHS COVID-19 Vaccine Provider. Once registration is complete, vaccine providers can request vaccines. Email COVID-19 Vaccination Enrollment or call the DSHS COVID-19 Vaccine Provider hotline at 877-835-7750 with questions. Read the DSHS Vaccine FAQs for more information.

Contact the pharmacy or vaccine supplier. Coordinate directly with your COVID-19 vaccine supplier to schedule vaccine administration for those who want the vaccine.

Use the following to locate vaccines:

CMS Adds COVID-19 Vaccination to ICF Rules (QSO-21-21-ICFIID)

August 27th, 2021

The Centers for Medicare and Medicaid Services issued Quality Safety & Oversight Memo QSO-21-21-ICFIID (PDF). The memo announces the addition of COVID-19 vaccine immunization-related requirements. This includes:

- New requirements for educating a person or their representatives as well as staff on the benefits and potential side effects with the COVID-19 vaccine.

- Offering the vaccine.

From DSHS website July 19th, 2021

How to Become a COVID‑19 Vaccinator

. Any facility, organization, or healthcare provider licensed to possess or administer vaccines or provide vaccination services is eligible to enroll through DSHS.

The first step to becoming a COVID‑19 vaccine provider is registering through EnrollTexasIZ.dshs.texas.gov.

Only providers registered through this site can receive and administer COVID‑19 vaccine in Texas.

For questions about registration, please call the DSHS COVID‑19 Vaccine Provider hotline at (877) 835-7750, 8 a.m. to 5 p.m., Monday through Friday or email COVID19VacEnroll@dshs.texas.gov.

Watch a joint video message from TMA President Dr. Fite and DSHS Commissioner Dr. Hellerstedt on COVID‑19 vaccine provider enrollment.

Registration Process

Each facility or location, including those that are part of a hospital system or clinic network, must register at EnrollTexasIZ.dshs.texas.gov, complete the Centers for Disease Control and Prevention (CDC) COVID‑19 Vaccination Program Provider Agreement and list the healthcare providers at that location that would be responsible for vaccination.

It is recommended to use the Google Chrome internet browser to complete the COVID‑19 Provider Agreement.

For example, each hospital in a hospital system must complete a registration separately and list vaccine providers there.

More information on the CDC requirements is below.

- COVID‑19 Vaccine Provider Frequently Asked Questions

- Patient Population Adjustment Form

- Texas DSHS Immunization Portal Registration Guide

- Tips and Tricks for Enrolling for COVID‑19 Vaccine Program

- Best Practices for Data Loggers

- COVID‑19 Vaccine Management Resources

After Registration

After completing enrollment, you will receive an email confirming your registration. Once approved, you will receive another email confirming your status as a COVID‑19 vaccine provider.

August 15th, 2021

COVID-19 Vaccination Data Reporting Rule: ICF

HHSC Long-term Care Regulation has published a revised version of the COVID-19 Vaccination Data Reporting Rule (PDF). The rule now includes Emergency Communication System Enrollment for Intermediate Care Facilities for Individuals with an Intellectual Disability or Related Conditions.

The rule requires facilities to report COVID-19 vaccination data within 24 hours and enroll in an emergency communication system. HHSC will inform facilities when they can begin enrollment.

The rule became effective Aug. 11.

February 23rd, 2021

IDD Vaccine Plan Approved (HCS/TxHmL/ICF)

February 12th, 2021

HCS/TxHmL:

Today DSHS reported it has finalized its presentation of the Tarrytown Expocare vaccine plan that the three IDD associations, Tarrytown and DSHS have been working on for many weeks. DSHS says the plan will be presented to DSHS Vaccine Leadership and the Commissioner today and also the Expert Vaccine Allocation Panel (EVAP) at its next meeting Monday morning. They expect to present this plan to the Governor’s Office Monday evening at which point DSHS feels it will have a final answer as to whether the plan is approved. Currently, we are not sure when it will be approved.

**This plan was developed using data the three IDD associations obtained from their respective members which include number of vaccines needed in both ICF/IID and HCS/TxHmL programs. Thank you for all the work our IDD associations do for providers and individuals in the program!)

- HHSC has not made a decision whether this same reporting requirements ICF requires, will be established for the HCS/TxHmL program.

February 12th, 2021

ICF/IID:

HHSC will soon release emergency rules and a Provider Letter related to the process it will use to identify which facilities (staff and residents) have already received the vaccine.

A stand-alone webinar on the requirement will also be held. Here is the link to draft Provider Letter and draft emergency rules

(So remember to update your policies and procedures for COVID-19 /infection control policies and procedures!!!)

ICF/IID providers will be required to complete a survey indicating how many residents and staff have received the vaccine (1st, 2nd, or both doses). The survey will be open for at least the duration of the emergency rule, requiring providers to add any new information about the status of the vaccines given This will allow providers to report 2nd doses given if such was not reflected in a provider’s first data entry (that is provided the individual received a 2-dose vaccine. Some vaccines will only have 1 dose- i.e. Astrozenica), or to report receipt of newly first-doses given.

After this three week period, HHSC will reconcile the data to identify where gaps exist. This process will include contacting providers as needed to confirm the information reported through the survey. HHSC anticipates the reconciliation process taking 2 or 3 days.

The data will then be sent to DSHS to be used to link providers still in need of the vaccine (whether 1st or 2nd dose) for the individuals they serve and their staff. This process will take about 2 weeks. The full process should take 5 weeks total, assuming HHSC completes its reconciliation process in a timely manner and DSHS is able to link providers to a vaccine entity in a speedy and efficient manner.

- Providers will not be cited on the rule, but it is possible to receive a citation from a desk audit (HHSC did not elaborate on this).

- The survey does not capture (and is not intended to capture) data on individuals who have opted not to receive the vaccine.

- Recognizing that not all providers are aware of or are tracking the vaccination status of their staff, providers only need only to report the number of staff of which they are aware have received the vaccine.

.

COVID-19 Information

COVID-19 FAQ’s Updated For HCS/TxHmL

HHSC has revised the Updated HCS and TxHmL COVID-19 FAQ (PDF) in response to the revised HCS and TxHmL COVID-19 Mitigation and Visitation rules.

September 21st,2021

COVID-19 Response Plan Revised HCS/TxHmL

COVID-19 Response Plan (PDF) in response to the revised HCS and TxHmL COVID-19 Mitigation and Visitation rules

9/21/21

Updated to reflect changes in response to GA-38 regarding facemasks and updated CDC guidance

The Table of Contents on pages 4 and 5 of the Response Plan will tell you what changes were made, each time the plan was revised, and the date.

February 22nd, 2021

COVID-19 FAQ’s From HHSC for HCS/TxHML

https://hhs.texas.gov/sites/default/files/documents/doing-business-with-hhs/provider-portal/long-term-care/hcs-txhml-general-covid-faq.pdf

January 7th, 2021

Texas Medicaid CHIP COVID-19 Information

Future meeting notices and information will continue to be shared on these sites, so please check back regularly.

December 2, 2020

Reminder: Requirements and Protocol for COVID-19 Emergency Staffing Requests

HHSC LTCR offers emergency staff for facilities facing severe critical shortages. Emergency staffing is only approved for facilities that can’t provide necessary care to residents due to staffing shortages. Emergency staffing is temporary while facilities get alternative staffing resources.

Facilities must have staffing contingency plans in place to address potential staffing shortages due to COVID-19. (42 CFR §483.73(b)(6)).

Facilities are required to have separate staff assigned to each COVID-19 cohort and not share staff between cohorts unless necessary to maintain adequate staffing (40 TAC §19.2802(i)).

Facilities may only request emergency staffing from HHSC if all the following contingency strategies have been exhausted.

- Share staff between unknown COVID-19 status and positive COVID-19 cohorts (see CDC guidance).

- Contact staffing agencies, nearby health care facilities, partners, or local colleges or health care centers to identify supplemental staff. (40 TAC §19.2802(j))

- Identify alternate facilities with adequate staffing to care for residents with COVID-19.

- Note: Nursing facilities must contact their LTCR Regional Director and local health department before using staff who are asymptomatic and have, or may have, COVID-19. This is generally only allowed in emergencies. Implement or attempt all other staffing contingency strategies listed above before this step.

If a facility has implemented or attempted each item listed above and still does not have adequate staff to meet critical staffing levels, the facility must contact the Regional Director for their LTCR Region to request emergency staffing.

If approved for emergency staffing, facilities must submit a transition plan for addressing shortages that includes the following.

- Forecasted timeline for when COVID-19 positive staff will return to work, using the CDC’s Return to Work criteria, and when emergency staff can be released.

- Acquiring temporary staff or recruiting new hires.

- All other strategies for ensuring critical staffing shortages are fulfilled as soon as possible.

December 2, 2020

Risk/Benefit Return to Activity Form (Free from our friends at HRS)

This could be very helpful for considerations for returning to work, Day Hab, Volunteer Jobs, etc…

https://hrstonline.com/download/risk-benefit-return-to-activity-form/?wpdmdl=3104&refresh=5fc779cf9f80e1606908367

Reminder to LTC Facilities about Death Reporting Requirements

July 22, 2020

The following are HHSC’s requirements for care facilities to report residents/individuals’ deaths to HHSC, including deaths from COVID-19.

- Intermediate care facilities must report all deaths to Complaint and Incident Intake within one hour. See: